What is Depreciation Expense?

Whenever a company acquires a durable asset, it is capitalized rather than liquidating in a given time. Since the assets are economical and generate revenues even after the accounting year, so expending it will exceed the value in that year and the future will understate the expense. Therefore to avoid the situation, depreciation expense is applied to balance the cost of a long durable asset with the generated revenue.

Depreciation expense is a section of a fixed asset that is considered to be consumed in the financial year. This depreciation amount is then entered on the income statement as an expense because the quoted value of the fixed assets will be consumed and decreased over time. It is a non-cash expense and not related to cash outflow.

Depreciation Expense Evaluation Methods

There are several techniques used to evaluate depreciation expense. However, the kind of depreciation evaluation methods applied depends on the category of tools and equipment used. The three conventional methods to calculate depreciation for businesses are as follows.

Straight-line depreciation – This method is commonly used and the easiest way to determine depreciation. This procedure takes a similar cost over the operational life of an asset.

For instance, an organization bought equipment for $50,000,000 and utilized it for 25 years without residual value. Therefore, the depreciation expense will be $50,000,000 divided by 25 years = $2,000,000. Depreciation formula for a straight line is given below.

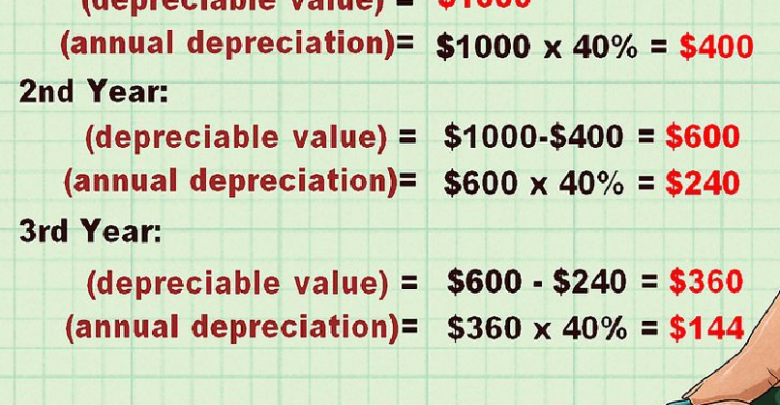

Declining Balance (accelerated depreciation) – This process is applied when an asset depreciates rapidly in the initial year. Depreciation formula for declining balance is given below. .

Units-of-production – The depreciation expense is evaluated by dividing a single unit by the fair value, unused value with the useful life of the units. This approach is the most convenient and beneficial for machinery production. Depreciation formula for units of production is given below.

To have a better understanding of commerce concepts, stay tuned to BYJU’S.